I havent posted for a while.

The numbers for October sales are out and market is still moving pretty strong.

Sacramento Real Estate

I love real estate and enjoy sharing my experience and findings with others. I hope you find it informative and enjoyable to read. I look forward to hearing from you.

Total Pageviews

Wednesday, November 6, 2019

Monday, July 22, 2019

June Market Update for Greater Sacramento Area

Here is the data for all Sacramento County areas combined. Some interesting trend: Take a look at the "For Sale" bars for April-June of 2019 and compare that to the same period last year. Notice the difference? We have/had 24.7% less homes for sale. That is huge. So, not as many homes for sale. Our "Sold" for the same period has been 9.6% less as well. Here is when it gets interesting: Our number of "Pending homes" for the same period (red line) has been up by 1.8%. This all does not translate to "Less people selling, and less people buying" Nope. It translates to "Less people selling (for whatever reason) but as many people buying". Less sellers, more buyers. Low supply, high demand. That's what pushing prices up. STILL. Low interest rates are one reason for that. We are having a strong market folks. That's my two cents.

Wednesday, June 19, 2019

What is Private Mortgage Insurance?

Whether it is your first time or your fifth, it is always important to know all the facts when it comes to buying a home. With the large number of mortgage programs available that allow buyers to purchase homes with down payments below 20%, you can never have too much information about Private Mortgage Insurance (PMI).

What is PMI?

Freddie Mac defines PMI as:

“An insurance policy that protects the lender if you are unable to pay your mortgage. It’s a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%.Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your mortgage payment.”

As the borrower, you pay the monthly premiums for the insurance policy, and the lender is the beneficiary. Freddie Mac goes on to explain that:

“The cost of PMI varies based on your loan-to-value ratio – the amount you owe on your mortgage compared to its value – and credit score, but you can expect to pay between $30 and $70 per month for every $100,000 borrowed.”

According to the National Association of Realtors, the average down payment for all buyers last year was 13%. For first-time buyers, that number dropped to 7%, while repeat buyers put down 16% (no doubt aided by the sale of their homes). This just goes to show that for a large number of buyers last year, PMI did not stop them from buying their dream homes.

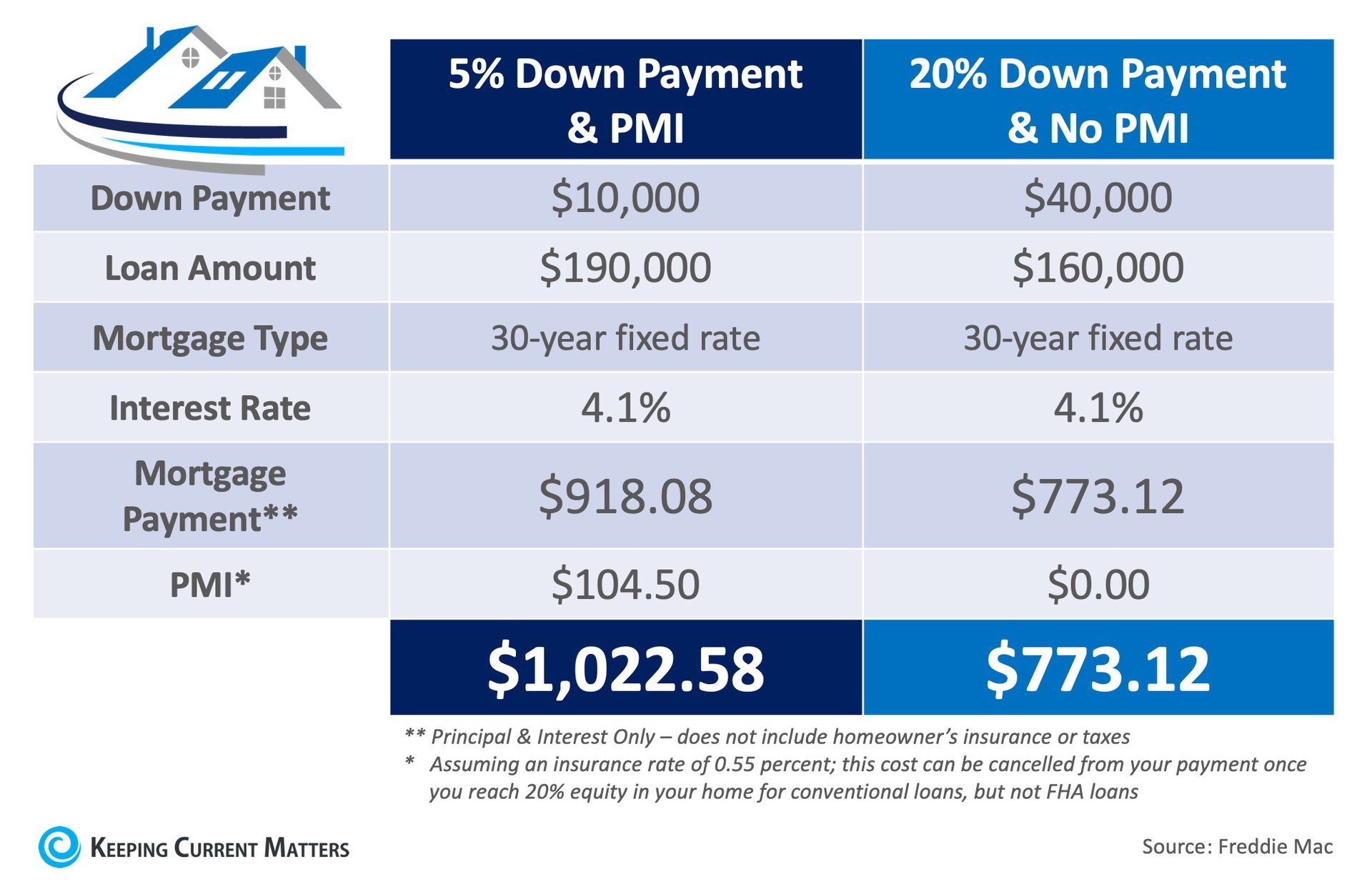

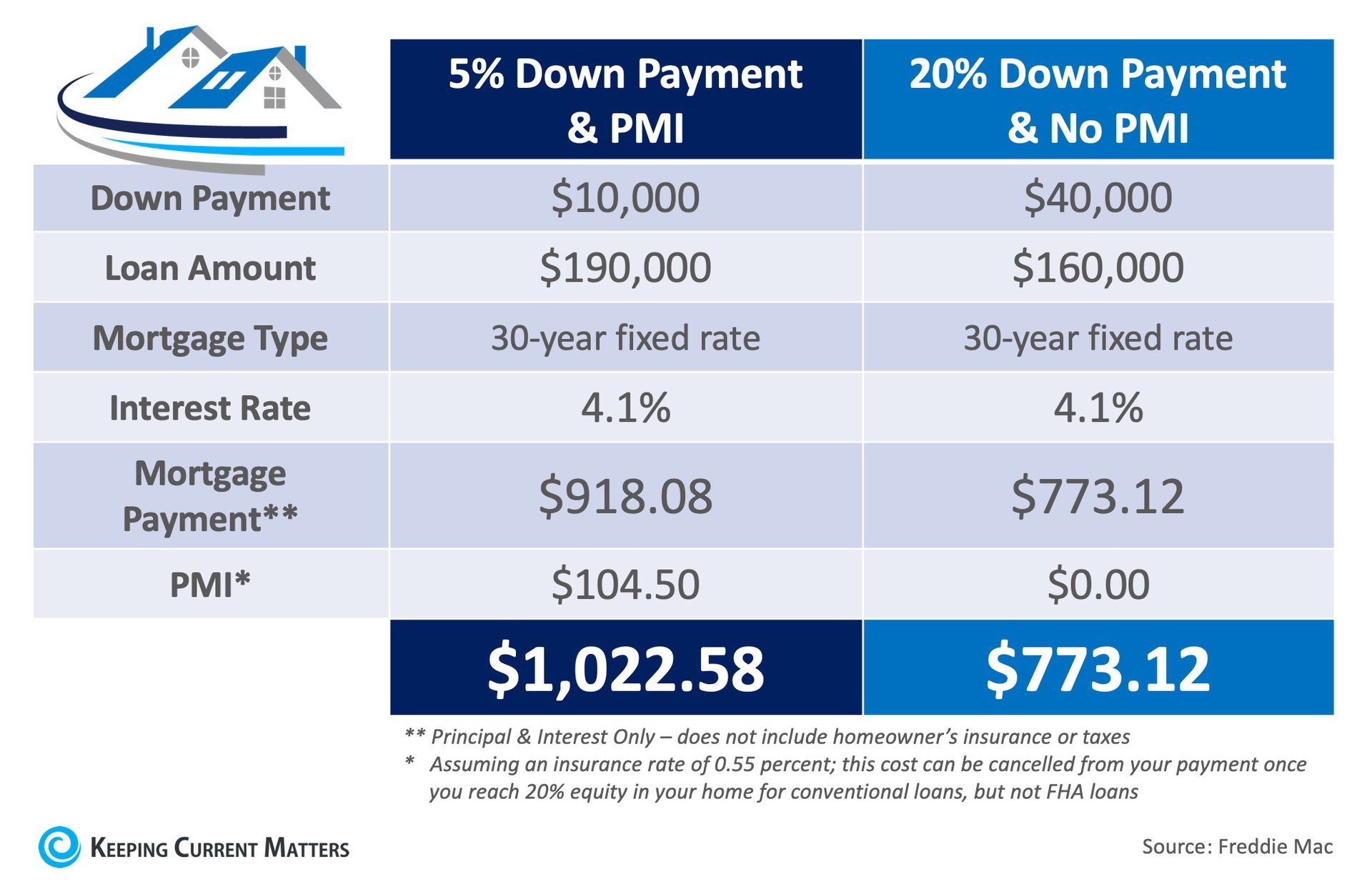

Here’s an example of the cost of a mortgage on a $200,000 home with a 5% down payment & PMI, compared to a 20% down payment without PMI: The larger the down payment you can make, the lower your monthly housing cost will be, but Freddie Mac urges you to remember:

The larger the down payment you can make, the lower your monthly housing cost will be, but Freddie Mac urges you to remember:

The larger the down payment you can make, the lower your monthly housing cost will be, but Freddie Mac urges you to remember:

The larger the down payment you can make, the lower your monthly housing cost will be, but Freddie Mac urges you to remember:“It’s no doubt an added cost, but it’s enabling you to buy now and begin building equity versus waiting 5 to 10 years to build enough savings for a 20% down payment.”

Bottom Line

If you have questions about whether you should buy now or wait until you’ve saved a larger down payment, meet with a professional in your area who can explain your market’s conditions and help you make the best decision for you and your family.

Thursday, June 13, 2019

May Market Update for greater Sacramento Area

In May, compared to last year, we had 18% less "For Sale" homes on the market. The number of "Solds" also decreased by 10.4%. That doesn't necessarily mean sky is falling down. You have to look at the big picture and several months of "trend" in order to make a conclusion.

Price-wise, "For Sale" prices rose 12.7% compared to May of last year. We also had an increase of 4.4% for "Sold" prices.

For those who know me, they know that I don't sit around. I'm always out and about, talking to realtors, appraisers, buyers and sellers, etc. I like to be "in the field". So far, I'm not seeing any signs of market slowing down. If homes are prices right, they sell within days with multiple offers. There are plenty of willing and capable buyers out there. However, as I have mentioned previously, buyers shy away from overpriced properties, even though we have a shortage of homes in our area (and nationally).

To buyers: Get pre-approved first and start looking for your dream house with the help of a professional agent like me.

To the sellers: Don't over price your home. Fair market value will get your homes sold and get you to where you need to be. Over price and you get to keep it. Remember: high percentage of the sales are done with a loan. That means YOUR HOME HAS TO APPRAISE. If it doesn't sale will not take place. Appraiser are trained professionals who have to justify the appraised value. That means even if you find a buyer willing to pay the outrageous amount you want to sell your house, it still needs to pass appraisal. If it doesn't, deal will fall through and you get to keep your home.

Price-wise, "For Sale" prices rose 12.7% compared to May of last year. We also had an increase of 4.4% for "Sold" prices.

For those who know me, they know that I don't sit around. I'm always out and about, talking to realtors, appraisers, buyers and sellers, etc. I like to be "in the field". So far, I'm not seeing any signs of market slowing down. If homes are prices right, they sell within days with multiple offers. There are plenty of willing and capable buyers out there. However, as I have mentioned previously, buyers shy away from overpriced properties, even though we have a shortage of homes in our area (and nationally).

To buyers: Get pre-approved first and start looking for your dream house with the help of a professional agent like me.

To the sellers: Don't over price your home. Fair market value will get your homes sold and get you to where you need to be. Over price and you get to keep it. Remember: high percentage of the sales are done with a loan. That means YOUR HOME HAS TO APPRAISE. If it doesn't sale will not take place. Appraiser are trained professionals who have to justify the appraised value. That means even if you find a buyer willing to pay the outrageous amount you want to sell your house, it still needs to pass appraisal. If it doesn't, deal will fall through and you get to keep your home.

Monday, May 13, 2019

How much should we offer now that we found the house we want to have?

This is how it works:

I start showing homes to qualified buyers, they see a property they like and must have, then the question pops up"So, how much do you think we should offer? Below? At? Or above asking price?"

How about " I don't know" for an answer. There is no one single, one size fits all, universal answer to this question. Every scenario is different and it's my job as your agent, as one who is looking after your interest, to start gathering information in order to give you the best advice. We don't want to pay too much for a property but we don't want to offer so low that our offer is not accepted either.

Every seller is different. But here are some key things to keep in mind:

Every seller is different. But here are some key things to keep in mind:

-How long has this property been on the market? If it's been on the market just a few days, chances are sellers are waiting to see how the market will react.

-Do they have any offers on the table and if they do, how many and are those offers over asking price? This is my job: I will contact their agent and see if I can get some information from them. His/her answer may be something like these:

-"We went on the market 4 days ago and we have several offer with one being over asking price." At which point I will try to find out what that offer is. Sometimes they cooperate and sometimes not.

-"We've been on the market for two weeks. No offers. Send in your offer".

-"We have one FHA offer under asking. If you can get me a conventional offer at or close to asking, I'm sure seller will entertain it."

So, as you see, a good, polite, friendly conversation with the listing agent, can reveal a lot. Good thing is I have common sense (not common any more) and I'm a good communicator. You would be surprised that a lot of agents in my profession simply are not so.

Based on the information I have gathered and looking at comparable Active, Pending and Sold properties, I will make a suggestion as to what to offer.

A lot of my offers get accepted simply because I make good suggestions to my clients.

Thinking of purchasing a house, give me a call. I will hold your hand and walk through the process. You don't want to have a not caring/inexperienced realtor represent you in the biggest financial decision of your life.

-"We went on the market 4 days ago and we have several offer with one being over asking price." At which point I will try to find out what that offer is. Sometimes they cooperate and sometimes not.

-"We've been on the market for two weeks. No offers. Send in your offer".

-"We have one FHA offer under asking. If you can get me a conventional offer at or close to asking, I'm sure seller will entertain it."

So, as you see, a good, polite, friendly conversation with the listing agent, can reveal a lot. Good thing is I have common sense (not common any more) and I'm a good communicator. You would be surprised that a lot of agents in my profession simply are not so.

Based on the information I have gathered and looking at comparable Active, Pending and Sold properties, I will make a suggestion as to what to offer.

A lot of my offers get accepted simply because I make good suggestions to my clients.

Thinking of purchasing a house, give me a call. I will hold your hand and walk through the process. You don't want to have a not caring/inexperienced realtor represent you in the biggest financial decision of your life.

Wednesday, March 27, 2019

February Market Update

Market fluctuates and for one to make a statement on what is happening in the market now and where we are heading, one needs to see several months of a "trend".

We do know that rates are still low and that is causing some buyers to be out there shopping. We also know that rain tends to keep some sellers from putting their homes on the market and we have had a particularly "wet" year. Yes, if you can't blame it on anything else, "Blame it on the rain". And April is just around the corner and that's when we see a jump in the number of homes going on the market. Let's see what happens in April. Bur for now, here are some stats for all Sacramento County areas combined.

Compared to the same month last year, in February (we are always one month behind in stats because we have to wait for numbers to come in) number of

For Sale homes went up 12%

Sold homes decreased by -15.9%

Pending properties went up 4.7%

Remember me mentioning the importance of "trends" when looking at the market, well, here are the stats for the past quarter compared to the same quarter last year:

For Sale homes went up 12%

Sold homes decreased by -20%

Pending homes decreased by -8.2%

So, yes homes are not selling as fast as they did last year.

I'm a member of an online group of Sacramento realtors and someone had asked the group what they all see. The common denominator was: "Buyers are looking for move-in ready homes and are willing to pay over asking." This is more so for the more affordable homes of say under 450K. Another comment several had mentioned which I have seen a lot is"Buyers have no problem walking away from overpriced properties." Today's buyer is very savvy:They have access to online sources plus their agents. They know how much homes are selling for. Overpriced homes don't even get viewed.

This is it for this month.

Interest rates are low. If you or anyone you know is thinking of buying or selling real estate, let me know.

We do know that rates are still low and that is causing some buyers to be out there shopping. We also know that rain tends to keep some sellers from putting their homes on the market and we have had a particularly "wet" year. Yes, if you can't blame it on anything else, "Blame it on the rain". And April is just around the corner and that's when we see a jump in the number of homes going on the market. Let's see what happens in April. Bur for now, here are some stats for all Sacramento County areas combined.

Compared to the same month last year, in February (we are always one month behind in stats because we have to wait for numbers to come in) number of

For Sale homes went up 12%

Sold homes decreased by -15.9%

Pending properties went up 4.7%

Remember me mentioning the importance of "trends" when looking at the market, well, here are the stats for the past quarter compared to the same quarter last year:

For Sale homes went up 12%

Sold homes decreased by -20%

Pending homes decreased by -8.2%

So, yes homes are not selling as fast as they did last year.

I'm a member of an online group of Sacramento realtors and someone had asked the group what they all see. The common denominator was: "Buyers are looking for move-in ready homes and are willing to pay over asking." This is more so for the more affordable homes of say under 450K. Another comment several had mentioned which I have seen a lot is"Buyers have no problem walking away from overpriced properties." Today's buyer is very savvy:They have access to online sources plus their agents. They know how much homes are selling for. Overpriced homes don't even get viewed.

This is it for this month.

Interest rates are low. If you or anyone you know is thinking of buying or selling real estate, let me know.

Thursday, February 21, 2019

January Market Update

I'm getting all of this month's report from

http://sacramentoappraisalblog.com/. Feel free to read the long version there. Here's my summary of it:

It's too early to draw any conclusions as to where the market is heading in 2019 as we need more months to draw a conclusion.

We've had 8 months of slum in sales volume but January number of pendings was normal. Mortgage rates have declined which could be one of the factors affecting that.

This January we had more listings in almost all price groups than we did in January of 2018. More listings translates to more homes to choose from for the buyers and more likely that buyers would walk away from a property due to high price or finding a more desirable home.

Market is definitely waking up and buyers are where they are supposed to be after the holidays: Out looking at homes, writing offers, buying homes.

Not seeing aggressive price gains: Median price change was the lowest in the past 6 years. Buyers aren't willing or able to pay the aggressive high prices they were paying before.Sellers had to be more reasonable than last few years to get their homes sold. That's where the 3.5% is coming from.

Here's another interesting graph to look at: Sales volume in Sacramento region is the lowest in the past 7 years. Not "sky is falling down" low but low"er". I believe we are heading for a slight correction in 2019. Something similar to what we have seen happening to January, is to happen for the rest of 2019. No crystal bowl here. Just an opinion.

Friday, January 11, 2019

More on where the market is heading in 2019

If you are really curious and willing to do lots of reading and observing graphs to see where the market is heading, I highly recommend you take a look at Sacramentoappraisalblog.com by Ryan Lindquest. He is the guru we realtors go to to ask questions about the market.

If you want the shorter version, read on. Below, I have a summary of what Ryan had in his most recent article.

1) During the second half of the year, rates hiked and there was a strong negative reaction to it by the buyers. Rates then went down. Great but affordability has gone down as well. It's not 2013 any more when rates were low and affordability was high. IMHO, rates aren't going to play a big role in this market.

2) This past December was the worst since 2007 in regards to sales volume. Volume was down %25 since the previous year. In fact, in the past 20 years, we have had only two other Decembers where it was lower than this past one. Is this a trend? Let's wait and see. I think it is but not every month will be %25 lower than the previous month. My opinion: Buyers are reacting to affordability (or lack of it) and dragging their feet. Sellers haven't got the message yet and are asking yesterday's price. Resulting in higher inventory, increasing "Days on Market".

3) If you scroll down and see my previous post, you will see that we had a "sexy", as R. Lindquest calls it, 2018. But when you look closer, you will see that the numbers for the past 3 to 6 months weren't anything to write home about.

So, I expect prices to come down due to higher inventory due to low affordability.

Call me if you had any questions.

If you want the shorter version, read on. Below, I have a summary of what Ryan had in his most recent article.

1) During the second half of the year, rates hiked and there was a strong negative reaction to it by the buyers. Rates then went down. Great but affordability has gone down as well. It's not 2013 any more when rates were low and affordability was high. IMHO, rates aren't going to play a big role in this market.

2) This past December was the worst since 2007 in regards to sales volume. Volume was down %25 since the previous year. In fact, in the past 20 years, we have had only two other Decembers where it was lower than this past one. Is this a trend? Let's wait and see. I think it is but not every month will be %25 lower than the previous month. My opinion: Buyers are reacting to affordability (or lack of it) and dragging their feet. Sellers haven't got the message yet and are asking yesterday's price. Resulting in higher inventory, increasing "Days on Market".

3) If you scroll down and see my previous post, you will see that we had a "sexy", as R. Lindquest calls it, 2018. But when you look closer, you will see that the numbers for the past 3 to 6 months weren't anything to write home about.

So, I expect prices to come down due to higher inventory due to low affordability.

Call me if you had any questions.

Wednesday, January 9, 2019

Sunday, December 23, 2018

November Market Update

I apologize for being a couple of weeks late this time. November numbers came out about two weeks ago.

So, here we go: (Graphs are all for Sacramento County.)

Graph 1: As you can see prices increased to north of 400k in April and more or less stayed the same. That is the red line I'm referring to. Green line is for what sellers were asking for their properties. There is always a large gap between these two numbers.

So, you might ask where do these numbers stand compared to say past ten years? Let's take a look at graph #2

Graph #2 shows average price of sold homes since ten years ago, 2008. In 2008 average price of sold home was approximately 200k. Now they're a bit over 400k. Yes if sellers held on to their homes, they got twice as much as 2008 in 2018 for their homes.

"Okay Bahman, are they still going up? That's what I want to know." Wait we're getting there. Let's take a look at graph #3.

Graph #3 is showing us home inventory in Sac County. As you can see it has been increasing since April. We went from 1.5 in November of 2017 to 2.2 in November of 2018. If I have to bet, I'd say next few months it's just going to go up. That means homes are going to go on the market but market will not absorb them and they will appear on the market again next months. If homes go on the market and buyers don't buy them, that is when inventory increases. The reason that since April, homes have been going on the market and buyers have not been buying them as fast, is high prices. Buyers are either not willing or not capable of buying them. That's causing the increase in inventory. Sellers have been witnessing this steady increase and are not willing to accept the reality that buyers can't / don't want to buy this high any more. I see and deal with them all day long in the field. I've seen homes that didn't sell for the price sellers were asking for it in 2018 and sellers decided to "take the house off the market and try it again in spring of 2019". Okie Dokie. Let's see how that works out. My estimate is we have the peak of the market behind us in 2017-2018. We are heading for a correction in 2019 and not for a price increase. I could be wrong. My crystal bowl is broken.

And here is graph #4 showing us inventory in the past ten years. See in the past, we did have high inventories (close to 4 months in 2010) but prices still rose because prices were low and buyers could buy. That is not the case for 2018-2019 any more. Prices have doubled and buyer are thinking "You know what?I think I'll just rent or wait till the summer and see what happens".This is my two cents. Don't think we're going to witness much price increase any more.

So, here we go: (Graphs are all for Sacramento County.)

Graph 1: As you can see prices increased to north of 400k in April and more or less stayed the same. That is the red line I'm referring to. Green line is for what sellers were asking for their properties. There is always a large gap between these two numbers.

So, you might ask where do these numbers stand compared to say past ten years? Let's take a look at graph #2

Graph #2 shows average price of sold homes since ten years ago, 2008. In 2008 average price of sold home was approximately 200k. Now they're a bit over 400k. Yes if sellers held on to their homes, they got twice as much as 2008 in 2018 for their homes.

"Okay Bahman, are they still going up? That's what I want to know." Wait we're getting there. Let's take a look at graph #3.

Graph #3 is showing us home inventory in Sac County. As you can see it has been increasing since April. We went from 1.5 in November of 2017 to 2.2 in November of 2018. If I have to bet, I'd say next few months it's just going to go up. That means homes are going to go on the market but market will not absorb them and they will appear on the market again next months. If homes go on the market and buyers don't buy them, that is when inventory increases. The reason that since April, homes have been going on the market and buyers have not been buying them as fast, is high prices. Buyers are either not willing or not capable of buying them. That's causing the increase in inventory. Sellers have been witnessing this steady increase and are not willing to accept the reality that buyers can't / don't want to buy this high any more. I see and deal with them all day long in the field. I've seen homes that didn't sell for the price sellers were asking for it in 2018 and sellers decided to "take the house off the market and try it again in spring of 2019". Okie Dokie. Let's see how that works out. My estimate is we have the peak of the market behind us in 2017-2018. We are heading for a correction in 2019 and not for a price increase. I could be wrong. My crystal bowl is broken.

And here is graph #4 showing us inventory in the past ten years. See in the past, we did have high inventories (close to 4 months in 2010) but prices still rose because prices were low and buyers could buy. That is not the case for 2018-2019 any more. Prices have doubled and buyer are thinking "You know what?I think I'll just rent or wait till the summer and see what happens".This is my two cents. Don't think we're going to witness much price increase any more.

Monday, December 10, 2018

Thursday, November 15, 2018

Time to winterize your home.

Found this article on US news. Hope you find it helpful.

IT'S OFFICIALLY FALL, which means winter is not far behind. The good news is that winter weather in much of the country is expected to be milder than last year's frigid conditions, and heating costs are also projected to be lower, according to a report from the U.S. Energy Information Administration. But the cost of heating one's home should still be a considerable expense in most parts of the country.

Heating is expensive enough already, so you don't want to pay for heat that escapes out windows, doors and cracks rather than staying inside and keeping you warm.

"A lot of time we're generating energy that we're sending out into the air," says Marianne Cusato, the housing advisor for HomeAdvisor.com and an associate professional specialist at the University of Notre Dame School of Architecture.

Fall is an ideal time to make repairs that will make your home more energy efficient, both saving you money and keeping you warmer. Even if you can't afford major repairs, such as a new furnace or new windows, there are small things you can do to save big bucks on heating costs – and you can handle most of them yourself.

"Homes can lose heat in a lot of different areas," says Anne Reagan, editor-in-chief of Porch.com. "I think that there's a lot of things that can be fixed in someone's home."

Here are 13 hacks to winterize your home while also trimming your heating bill.

Caulk around windows. Warm air can escape and cold air can enter your house if the area around your windows has cracks. Caulking needs to be replaced periodically, and you should check every fall for holes that need to be patched, as well as holes anywhere outside your house. "You want to make sure your [home's] envelope is secure," Cusato says.

Replace weatherstripping around doors. If you can see light around the edges of your doors, you need new weatherstripping. "A small weatherstripping costs you five or six dollars, and it will save you hundreds of dollars in electrical bills," says J.B. Sassano, president of the Mr. Handyman franchise company.

Close up your fireplace. Make sure your flue closes all the way, and check whether you can feel air coming in when it's closed. Glass doors around your fireplace opening are another way to keep warm air in and cold air out of your house.

Put up storm windows and doors. If you have older windows and doors, adding storm windows and doors can help considerably. Window insulation film is another option to provide a layer of protection. "It really insulates the window," Sassano says.

Add heavy drapes and rugs. Changing light summer drapes for heavy winter drapes was common in earlier times, and it's still helpful, Reagan says. Drapes can keep the room warmer, while putting down rugs provides a layer of insulation above the floor.

Improve your insulation. Insulation deteriorates over time, so you may want to add more material in your attic. Other places to add insulation are in crawl spaces and exposed areas of decks. Sassano also recommends creating a false ceiling in unfinished basements and insulating between that ceiling and the living area. An insulating cover over your attic opening also helps trap in the heat.

Cover your water heater. You can buy a water heater blanket for around $20 at the hardware store that will keep the tank from losing heat as quickly, saving you money on your heating bill.

Get an energy audit. Many utility companies will provide a free energy audit and give you suggestions on improvements you can make to your home. You can also pay for a more extensive energy audit. "They'll look at all the places you're losing energy," Cusato says.

Change your furnace filters. If the filters are dirty, your furnace has to work harder. In most homes, filters should be changed monthly in the heating season. You should also have your furnace serviced periodically to make sure it is working properly. "It's easy to overlook but it can mean your system isn't working efficiently," Cusato says.

Get a programmable thermostat. The newest thermostats can learn your family's habits and set themselves to keep the house cooler when no one is there and warmer when the home is occupied. You can also purchase a more basic programmable thermostat. Prices vary considerably, depending on how sophisticated you want your thermostat to be.

Lower your water heater temperature. You can lower it from 140 degrees to 120 with no ill effect, Cusato says. And 120 degrees is the temperature recommended by the Consumer Product Safety Commission.

Replace less efficient windows and doors. Adding double- or triple-pane windows, insulated doors and insulated garage doors will significantly improve the energy efficiency of your home.

Lower the thermostat. It's actually more comfortable to sleep in a colder home, and you can always add more blankets. When you're awake, wear a sweater or sweatshirt to stay comfortable with a lower thermostat setting.

Thursday, November 8, 2018

October Market Update

Numbers are out for October. As you can see, price of "sold" homes have increased in most areas. Yes, compared to last year same month, homes sold for more. However, when trying to figure out the market, we need to look at more than one metric.

Look at the graph below for Sacramento County. The orange bar graph shows the "Days On Market". (Average # of days it took for homes to sell)

For August to October of 2017, numbers were 24, 26, 28.

In 2018 these numbers were 28,30,36.

Conclusion: Last quarter it took longer time to sell homes than same quarter last year.

Loot at the green line in the same graph which shows what % of the original list price, sellers were able to get for their homes.

Those numbers for August to October of 2017 were 99, 99, 98.

This year, they were 98, 98, 97. You might think there is no significant change. Well, there is because these numbers normally fluctuate between say, 95 to 105.

Let me put it in perspective for you: In Sacramento county, average price of a sold home was $406,000. In this market if SP/Orig LP % is 100%, then it means on average, all the homes were sold for $406,000, the asking price. Cool ha? Now, let's imagine in the same market, this metric is 97%, (like it was in October of this year, meaning their homes were sold at %97 of the list price which is $394,000. You might say" Big deal.So a house was listed for $406k and was sold for $394k." NO! We are looking at the data of A WHOLE COUNTY, County of Sacramento. That's almost 1400 sold homes. 1400 homes were sold at 97% of the asking price. That IS a rather big deal. No sky is not falling on real estate market but it must be kept in perspective when trying to figure out the trend.

This next graph shows the "Inventory" for county of Sacramento. Here is a good definition of "Inventory" I found online:Months of supply (or inventory) is the measure of how many months it would take for the current inventory of homes on the market to sell, given the current pace of home sales. For example, if there are 50 homes on the market and 10 homes selling each month, there is a 5 month supply of homes for sale.

I'm going to quote Ryan Lundquist, the leading appraiser in Sacramento county who writes for Sacramento Bee and often is interviewed by local TV chanals. He says that "you don't often see market changing by looking at prices." One first sees it in other metrics like sales volume, days on market and inventory(months of supply) then prices follow. We are, IMHO, in that phase right now. We are at the beginning of the shift. Sellers are pricing their homes high and buyers are not willing to pay that amount. This results in high inventory, more days on market and getting less than what they listed their home for.

Next few months will be slow due to holidays. What is it going to look like in the spring? (California spring market begins as soon as Christmas lights are down) I don't have a crystal ball but if I had to bet, I would bet on prices going down next year.

If you're thinking of buying or selling a house, I highly recommend you do your own research. This is my blog and these are solely my opinions.

You can look at Ryan's blog by going to http://sacramentoappraisalblog.com/

Look at the graph below for Sacramento County. The orange bar graph shows the "Days On Market". (Average # of days it took for homes to sell)

For August to October of 2017, numbers were 24, 26, 28.

In 2018 these numbers were 28,30,36.

Conclusion: Last quarter it took longer time to sell homes than same quarter last year.

Loot at the green line in the same graph which shows what % of the original list price, sellers were able to get for their homes.

Those numbers for August to October of 2017 were 99, 99, 98.

This year, they were 98, 98, 97. You might think there is no significant change. Well, there is because these numbers normally fluctuate between say, 95 to 105.

Let me put it in perspective for you: In Sacramento county, average price of a sold home was $406,000. In this market if SP/Orig LP % is 100%, then it means on average, all the homes were sold for $406,000, the asking price. Cool ha? Now, let's imagine in the same market, this metric is 97%, (like it was in October of this year, meaning their homes were sold at %97 of the list price which is $394,000. You might say" Big deal.So a house was listed for $406k and was sold for $394k." NO! We are looking at the data of A WHOLE COUNTY, County of Sacramento. That's almost 1400 sold homes. 1400 homes were sold at 97% of the asking price. That IS a rather big deal. No sky is not falling on real estate market but it must be kept in perspective when trying to figure out the trend.

This next graph shows the "Inventory" for county of Sacramento. Here is a good definition of "Inventory" I found online:Months of supply (or inventory) is the measure of how many months it would take for the current inventory of homes on the market to sell, given the current pace of home sales. For example, if there are 50 homes on the market and 10 homes selling each month, there is a 5 month supply of homes for sale.

Months of supply is a good indicator of whether a particular real estate market is favoring buyers or sellers. Typically, a market that favors sellers has less than 6 months of supply, while more than 6 months of supply indicates an excess of homes for sale that favors buyers.

Let's look at numbers: August to October 2017: 1.4, 1.6, 1.6.

This year: 1.8, 2.4, 2.1. Conclusion: More homes to choose from this past quarter than same quarter last year. Good news for the buyers.

So you might ask "Bahman, you're contradicting yourself. You said prices are still going up but you're also stating that inventory is higher, it's taking longer for homes to sell, and sellers aren't getting what they want for their homes. So, what is it?" Well, answers to "Where is real estate market heading?" isn't always a simple "It's going up (or down)" or "Oh, it's very much a seller's (or buyer's) market". I'm going to quote Ryan Lundquist, the leading appraiser in Sacramento county who writes for Sacramento Bee and often is interviewed by local TV chanals. He says that "you don't often see market changing by looking at prices." One first sees it in other metrics like sales volume, days on market and inventory(months of supply) then prices follow. We are, IMHO, in that phase right now. We are at the beginning of the shift. Sellers are pricing their homes high and buyers are not willing to pay that amount. This results in high inventory, more days on market and getting less than what they listed their home for.

Next few months will be slow due to holidays. What is it going to look like in the spring? (California spring market begins as soon as Christmas lights are down) I don't have a crystal ball but if I had to bet, I would bet on prices going down next year.

If you're thinking of buying or selling a house, I highly recommend you do your own research. This is my blog and these are solely my opinions.

You can look at Ryan's blog by going to http://sacramentoappraisalblog.com/

Monday, October 29, 2018

September Market Update

Prices are still showing a strong increase in September (Forgive me for posting them late. October data will be available to me in about 6 to 10 days). We are witnessing the beginning of the correction of the market. Days on market is increasing and so is the inventory. And let's don't forget the interest rates which have gone up a good 0.5 percent this year. (That is not all that significant). Still makes more sense to buy than to rent. We have seen slowing down of the market in the Bay Area as well as in Southern California. If I could predict the future, I will be in Vegas but my guess is that comes spring, we will be witnessing a decrease in prices. If buyers aren't buying, sellers have to reduce the price to entice them. It's the law of Supply and Demand. It's that simple.

During the holidays, there aren't as many buyers but also keep in mind that lots of sellers will take their homes off the market to enjoy it with their families. If you need to sell your house, holidays might not be a bad time. Give me a call. Let's come up with a strategy to sell it and get you to where you want to be.

If you live in a area that that I don't include in my monthly reports, just let me know. I'll get it to you.

Tuesday, October 9, 2018

Should sellers "fix things" before putting their house up for sale?

Not long ago, I was contacted by a homeowner asking me if it was a good idea that he repairs broken things in the house before proceeding with the sale or is it a better idea to leave it to the buyer to do the inspections and only then he repairs the items that the buyers ask for.

Let's call them scenario 1 and 2.

Scenario 1: Seller takes care of things himself. He starts by hiring a home inspector (about $450) and a pest inspector (about $110) to first find out what needs to be fixed. Then he on his clock, on his terms, gets bids from his vendors and hires whomever he finds more suitable to do the repairs. HE IS IN CONTROL. And once he is ready to sell the house, he will provide a "Clean Bill of Health" to the buyers by providing them with the inspection reports and the repair receipts. In this scenario, he will get more $ for his house in a shorter time and will avoid surprises and headaches.

Scenario 2: Seller will do no inspections or repairs prior to putting the house on the market. Not even the obvious things he is aware of like a not working garage door or broken, leaking fence or leaking water faucet. Buyer hires a home and a pest inspector to inspect the house. Inspectors will prepare reports and hand them to the buyers. Buyers will review them and gives those reports along with a list of repairs he wants seller to do to the seller. By this point, we are probably at day 15 of a 30 day escrow. Seller is in a shock because he didn't expect all these things to be wrong with his house. Now he has to start looking for roofers, plumbers, handymen, garage door opener repair guys, landscapers, pool guys and find out how much they charge to fix things. And seller doesn't have all the time in the world to get several different bids from several different vendors so he will end up taking what he can which might not be the best bid after all. Trust me:It's hectic and stressful and it's less money in the pocket of the seller.

Am I making sense?

Let me summarize it again this way:

Scenario 1:

Seller does repairs on his time/on his terms/with vendors he likes/chooses = Seller is in control = More $ in seller's pocket + quicker/less stressful sale.

Scenario 2:

Buyer does the inspection then asks for repairs = Surprises for the seller = Seller is not in control = hiring the first repairman available or accepting the first estimate = less money in seller's pocket + more stress.

Now, a home inspection is pricey, about $450. In my opinion, it's worth every penny and, the seller will get it and then some when he pays for it and take care of the repairs himself. But if he doesn't want to invest that, then at least I suggest spending the $110 pest inspection and taking care of what pest inspector suggests. (And of course take care of the obvious things he knows are in need of repair.

See, pest inspectors (among other issues) will let you know if you have leaks under your sinks (very common), loose toilet bowls or leaks from them, termite (not very common) and dry rot (very common for outside of the property due to rain/sprinklers), present or past existence of rodents in the attic/garage and crawl space (if there is one). I highly recommend hiring one. Sometimes folks step over a dollar to save a dime. We see it in real estate all day long.

I hope this helped.

Let's call them scenario 1 and 2.

Scenario 1: Seller takes care of things himself. He starts by hiring a home inspector (about $450) and a pest inspector (about $110) to first find out what needs to be fixed. Then he on his clock, on his terms, gets bids from his vendors and hires whomever he finds more suitable to do the repairs. HE IS IN CONTROL. And once he is ready to sell the house, he will provide a "Clean Bill of Health" to the buyers by providing them with the inspection reports and the repair receipts. In this scenario, he will get more $ for his house in a shorter time and will avoid surprises and headaches.

Scenario 2: Seller will do no inspections or repairs prior to putting the house on the market. Not even the obvious things he is aware of like a not working garage door or broken, leaking fence or leaking water faucet. Buyer hires a home and a pest inspector to inspect the house. Inspectors will prepare reports and hand them to the buyers. Buyers will review them and gives those reports along with a list of repairs he wants seller to do to the seller. By this point, we are probably at day 15 of a 30 day escrow. Seller is in a shock because he didn't expect all these things to be wrong with his house. Now he has to start looking for roofers, plumbers, handymen, garage door opener repair guys, landscapers, pool guys and find out how much they charge to fix things. And seller doesn't have all the time in the world to get several different bids from several different vendors so he will end up taking what he can which might not be the best bid after all. Trust me:It's hectic and stressful and it's less money in the pocket of the seller.

Am I making sense?

Let me summarize it again this way:

Scenario 1:

Seller does repairs on his time/on his terms/with vendors he likes/chooses = Seller is in control = More $ in seller's pocket + quicker/less stressful sale.

Scenario 2:

Buyer does the inspection then asks for repairs = Surprises for the seller = Seller is not in control = hiring the first repairman available or accepting the first estimate = less money in seller's pocket + more stress.

Now, a home inspection is pricey, about $450. In my opinion, it's worth every penny and, the seller will get it and then some when he pays for it and take care of the repairs himself. But if he doesn't want to invest that, then at least I suggest spending the $110 pest inspection and taking care of what pest inspector suggests. (And of course take care of the obvious things he knows are in need of repair.

See, pest inspectors (among other issues) will let you know if you have leaks under your sinks (very common), loose toilet bowls or leaks from them, termite (not very common) and dry rot (very common for outside of the property due to rain/sprinklers), present or past existence of rodents in the attic/garage and crawl space (if there is one). I highly recommend hiring one. Sometimes folks step over a dollar to save a dime. We see it in real estate all day long.

I hope this helped.

Monday, October 1, 2018

August Market Update.

August numbers are reflecting a strong market: We are still seeing a strong increase in price of sold homes. How much longer is this trend going to continue? I'm watching the market closely and as I mentioned in my last post, we are seeing signs that indicate we are about to witness a change: Inventory is higher than before and homes are taking longer to sell. Nobody has a crystal ball but my prediction is that we will be witnessing softening of the market soon.

Wednesday, September 26, 2018

What is PMI? Should it keep you from becoming a homeowner?

The Cost Of NOT Paying PMI

Saving for a down payment is often the biggest hurdle for a first-time homebuyer as median incomes, rents, and home prices all vary depending on where you live.

There is a common misconception among homebuyers that a 20% down payment is required, and it is this limiting belief that often adds months, and sometimes even years, to the home-buying process.

So, if you can purchase a home with less than a 20% down payment… why aren’t more people doing just that?

One Possible Answer: Private Mortgage Insurance (PMI)

Freddie Mac defines PMI as:

“An insurance policy that protects the lender if you are unable to pay your mortgage. It’s a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%.Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your mortgage payment.”

As the borrower, you pay the monthly premiums for the insurance policy, and the lender is the beneficiary. The monthly cost of your PMI depends on the home’s value, the amount of your down payment, and your credit score.

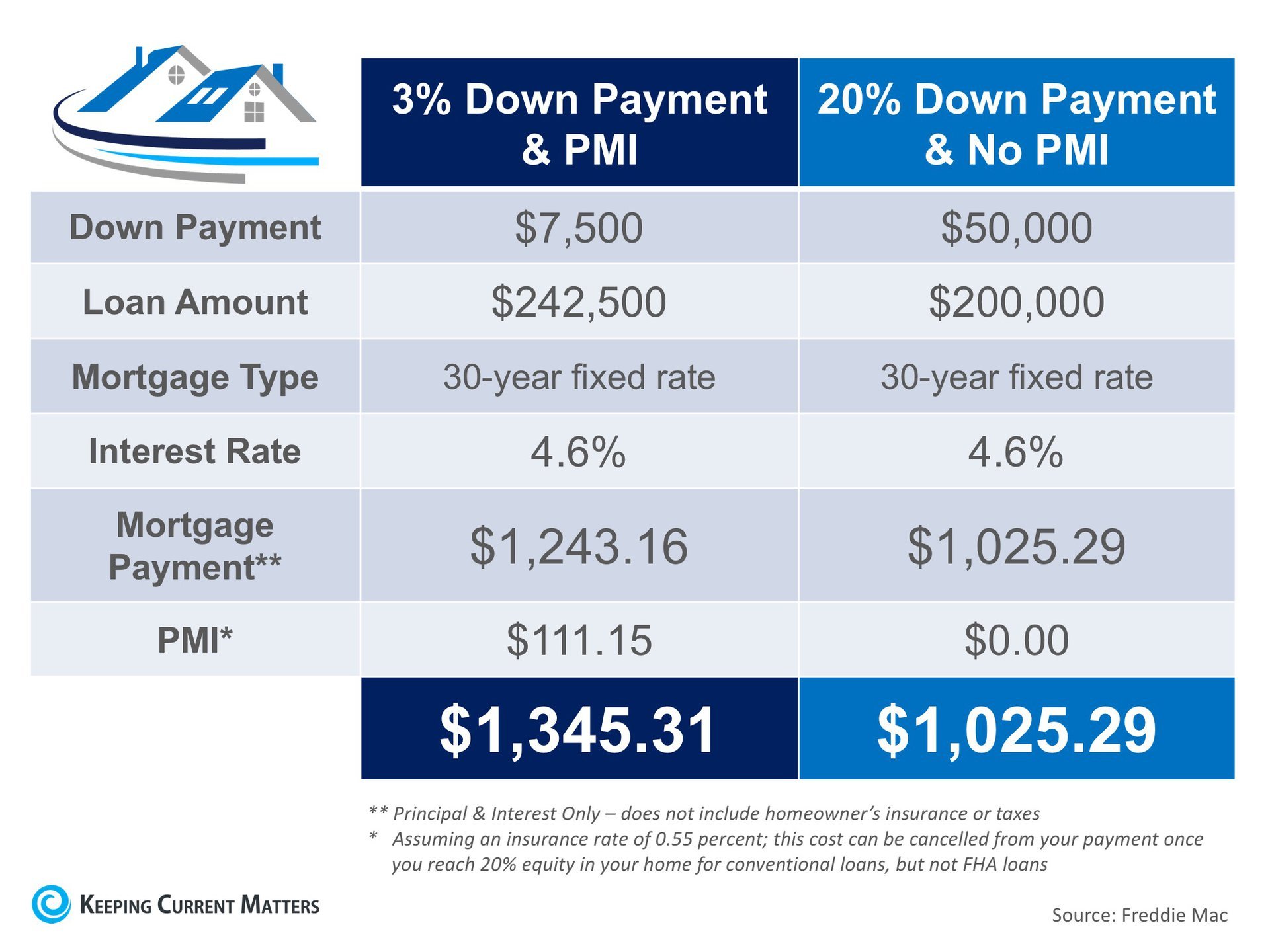

Below is a table showing the difference in monthly mortgage payment for a $250,000 home with a 3% down payment and PMI vs. a 20% down payment without PMI:

The first thing you see when looking at the table above is no doubt the added $320 a month that you would be spending on your monthly mortgage cost. The second thing that should stand out is that a 20% down payment is $50,000!

If you are buying your first home, $50,000 is a large sum of money that takes discipline and sacrifice to save. Many first-time buyers save for 5-10 years before buying their homes.

To save $50,000 in 10 years, you would need to save about $420 a month. On the other hand, if you save that same $420 a month, you could afford a 3% down payment in less than a year and a half.

In a recent article by My Mortgage Insider, they explain what could happen in the market while you are waiting to save for a higher down payment:

“The time it takes to save a (larger) down payment could mean higher home prices and tougher qualifying down the road. For many buyers, it could prove much cheaper and quicker to opt for the 3% down mortgage immediately.”

The article went on to say,

“Since renters typically devote a higher percentage of their income to housing than homeowners, providing flexible down payment options can help renters with solid earnings purchase a home – and gain a fixed-rate mortgage with principal and interest payments that will not increase over the life of the loan.”

If the prospect of having to pay PMI is holding you back from buying a home today, Freddie Mac has this advice,

“It’s no doubt an added cost, but it’s enabling you to buy now and begin building equity versus waiting 5 to 10 years to build enough savings for a 20% down payment.”

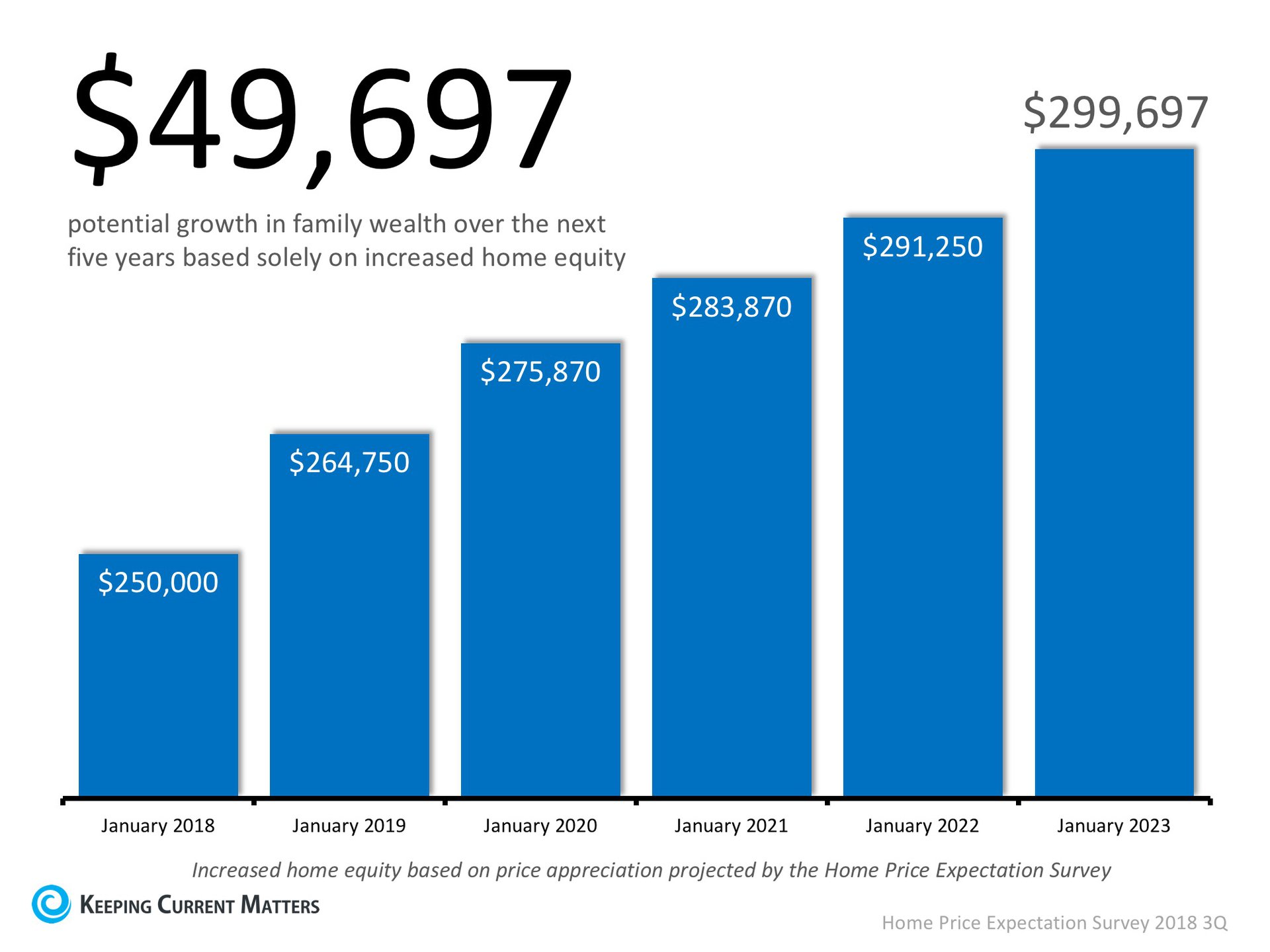

Based on results of the most recent Home Price Expectation Survey, a homeowner who purchased a $250,000 home in January would gain $50,000 in equity over the next five years based on home price appreciation alone (shown below).

Bottom Line

If you have questions about whether you should buy now or wait until you’ve saved a larger down payment, meet with a professional in your area who can explain your market’s conditions and help you make the best decision for you and your family.

Subscribe to:

Comments (Atom)